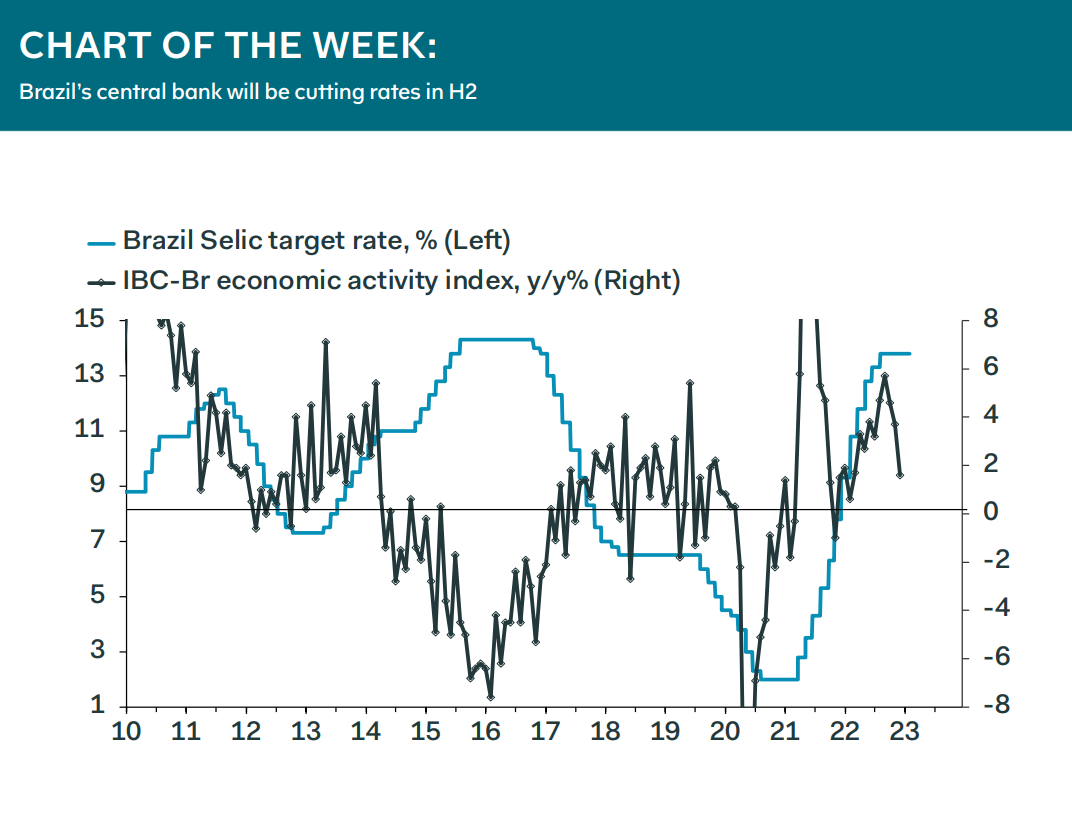

As widely expected, Brazil’s central bank policy board—COPOM—last week kept the Selic rate at 13.75%, for a fourth straight meeting. The statement maintains the Bank’s cautious approach, striking a dovish tone on growth but noting that inflation is “above the range compatible with meeting the inflation target”, despite the recent downtrend; the Bank raised its inflation forecasts. The statement says that risks to the Bank’s base case inflation forecast remain balanced, as usual. The upside risks are greater persistence of global inflationary pressures, heightened uncertainty about fiscal policy, and a smaller-than-expected output gap, “especially in the labour market”. The downside risks are further declines in commodity prices, a sharper[1]than-expected global economic slowdown, and the continuation of indirect tax cuts, which currently are assumed to reverse this year.

We think the Bank will keep interest rates on hold in H1. Increased fiscal uncertainty and unwelcome political noise are pushing inflation expectations higher, but the growth data are already making a compelling case for policymakers to ease. We think they will be able to start cutting rates in H2, as the government is likely to act sensibly on the fiscal front, but risks abound.

Andres Abadia, Chief LatAm Economist