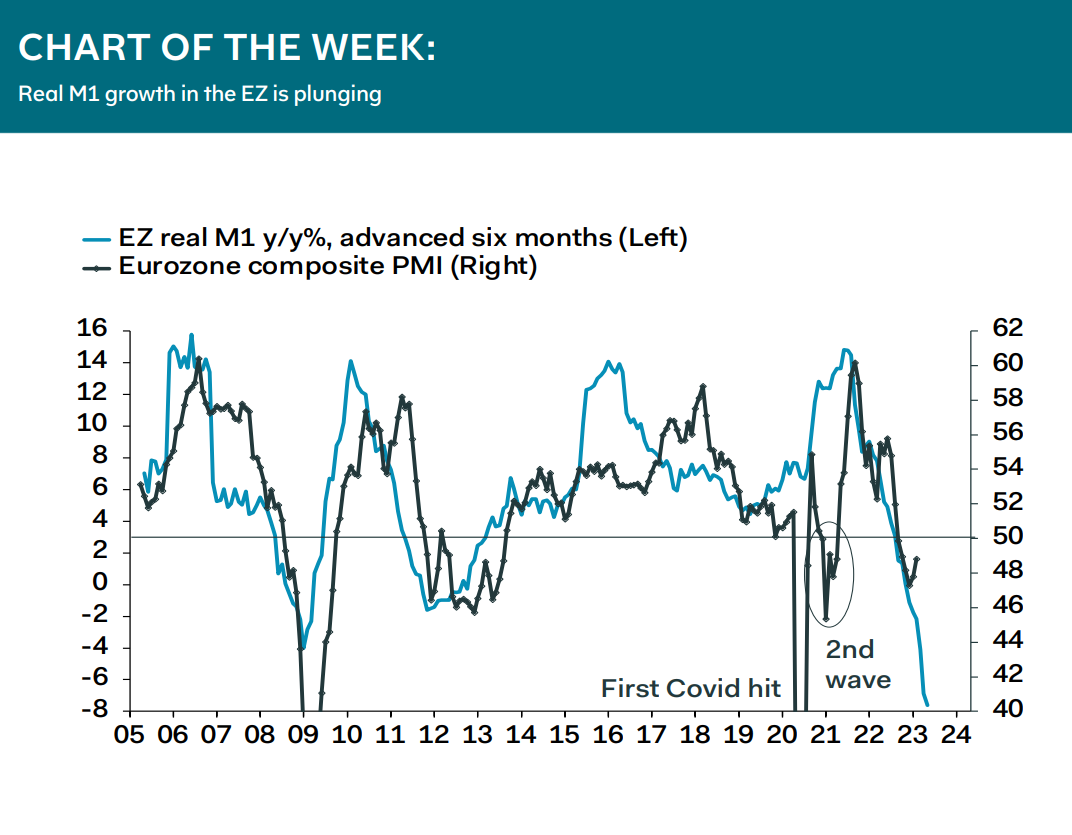

Data over the holidays revealed that narrow money growth in the Eurozone slowed further at the end of 2022. Our chart of the week shows that real M1 growth—overnight deposits deflated by the CPI—is now more depressed than during the financial crisis. This message has to be taken with a pinch of salt. The collapse in narrow money supply growth is partly a mirror-image of the surge during Covid when households had to stay at home, while enjoying near-full income suport from governments. That said, the signal from real M1

growth is disconcerting, all the same. It indicates that risks to our GDP growth forecasts are firmly tilted to the downside. More specifically, it implies that the recent rebound in the EZ composite PMI won’t be long for this world, as clearly shown by the chart above.

Claus Vistesen, Chief Eurozone Economist