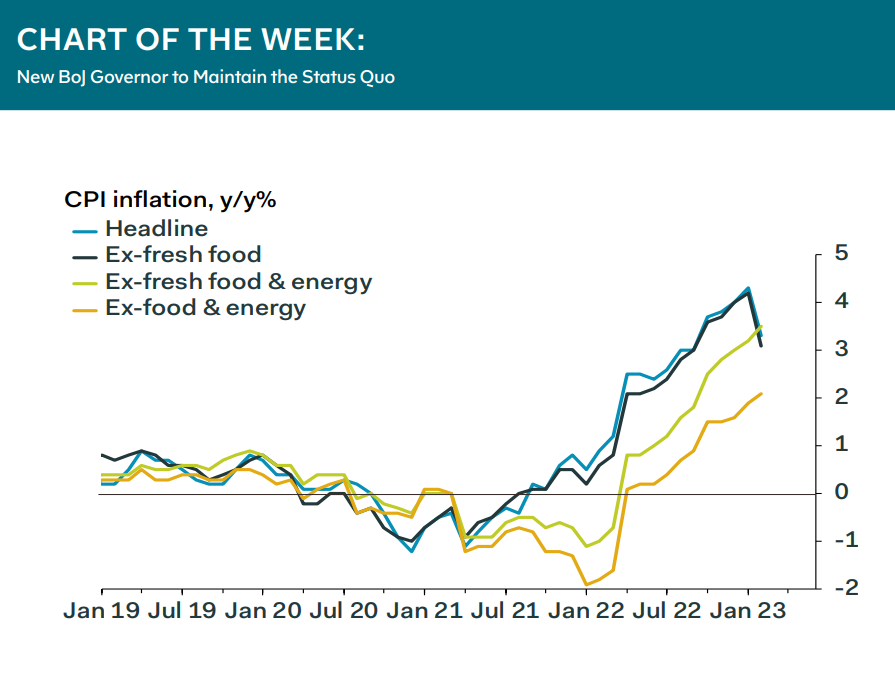

Japanese inflation rolled over in February, thanks entirely to government energy subsidies. By contrast, both food and underlying core inflation accelerated. But this won’t persist. Japan’s inflation stems mostly from higher import costs, and is likely to slow as a result of the steadier yen since November and sharply lower international energy inflation. The BoJ’s next policy meeting, on April 28, will be the first under its new governor, Kazuo Ueda.

Mr. Ueda is a pragmatist, who recently told the legislature that current easy policy settings are appropriate for current economic conditions. The ongoing international banking crises will reinforce the case for leaving policy settings unchanged in April; inflation is set to edge down and the domestic economy is unlikely to enter into a self-sustaining recovery while global conditions are so lacklustre. We think Mr. Ueda will explore ways of adjusting the yield curve control policy to make it more sustainable, but he is likely to retain the view that Japan’s economy needs easy monetary policy for the rest of this year.

Duncan Wigley, Chief China+ Economist