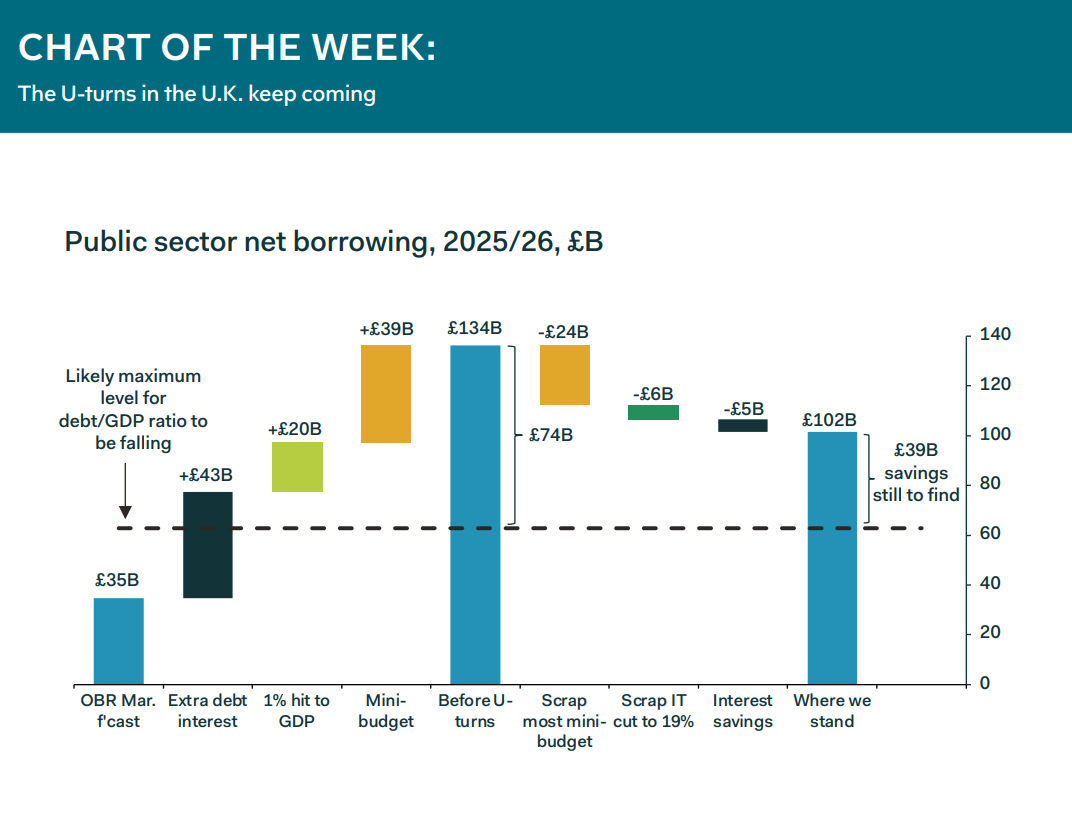

The past few weeks have been wild for both the U.K. economy and the political establishment, and it’s not over yet. By our calculations, the new Chancellor, Jeremy Hunt, still needs to find £39B in savings to ensure that the debt-to-GDP ratio keeps falling through the forecast horizon, as our chart of the week shows. Indeed, we think the Chancellor is looking for something closer to £50B, to give himself some headroom for tax cuts ahead of the next general election. But finding £50B will be very difficult with spending cuts alone, so we expect a 75/25 split between spending cuts and tax increases. This, inevitably, will invite arguments that the Chancellor is now overdoing the tightening. Maybe he is; the uncertainties are so great that it is difficult to tell. What is clear, though, is the idea that policy announcement sometimes are reality-checked by markets, and that the ensuing mopping-up exercise can be painful.

Samuel Tombs, Chief U.K. Economist