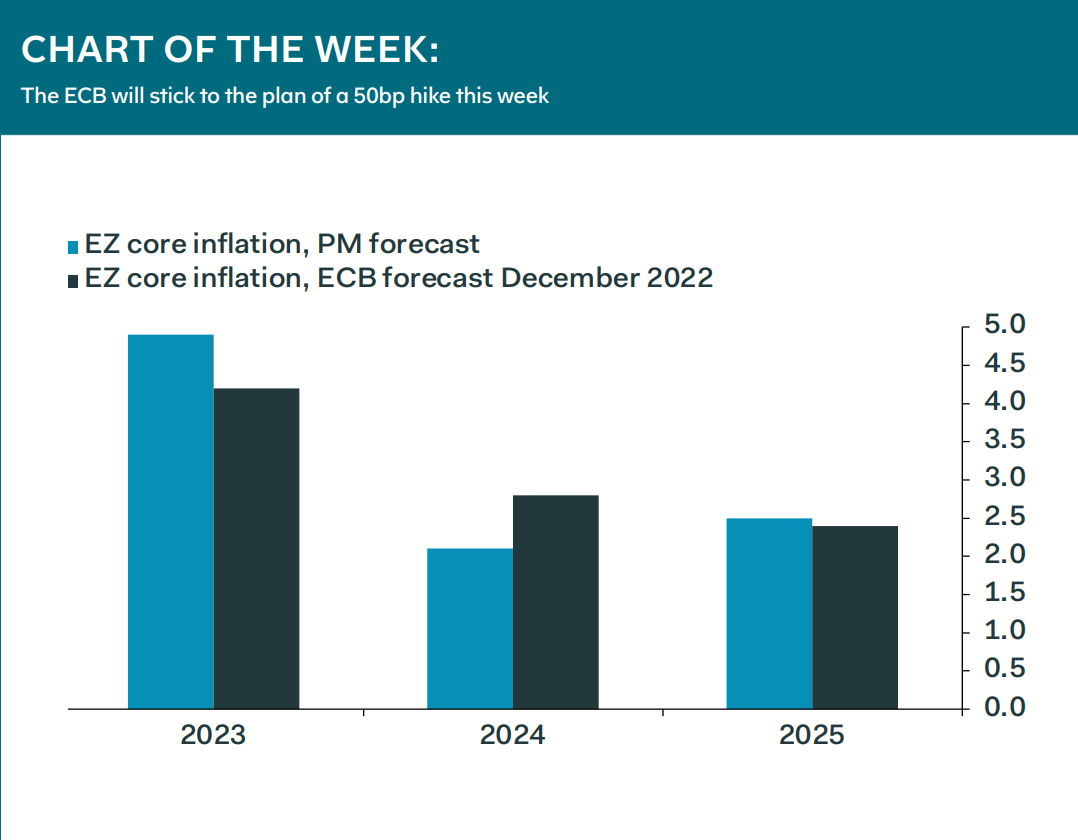

The main outcome of this week’s ECB policy meeting should be a foregone conclusion, after the central bank all but promised a 50bp rate hike last month. We still think the ECB will deliver on this pledge, but the surge in volatility in response to the SVB and Signature failures, however, has cast doubt over the central bank’s near-term reaction function. Yields and interest rate expectations collapsed at the start of the week as markets focused on the crash in U.S. regional bank equities. They have since rebounded, which we think is the right move as far as this week’s ECB decision is concerned. Our chart of the week shows that the central bank likely will lift its near-term core inflation forecasts. This will weigh more heavily for the interest rate decision than volatility on the back of SVB’s demise, unless conditions deteriorate rapidly in the next few days. Looking further ahead, we still think the ECB will lift its policy rates by 50bp again in May, before finishing this hiking cycle with a 25bp hike in June.

Claus Vistesen, Chief Eurozone Economist