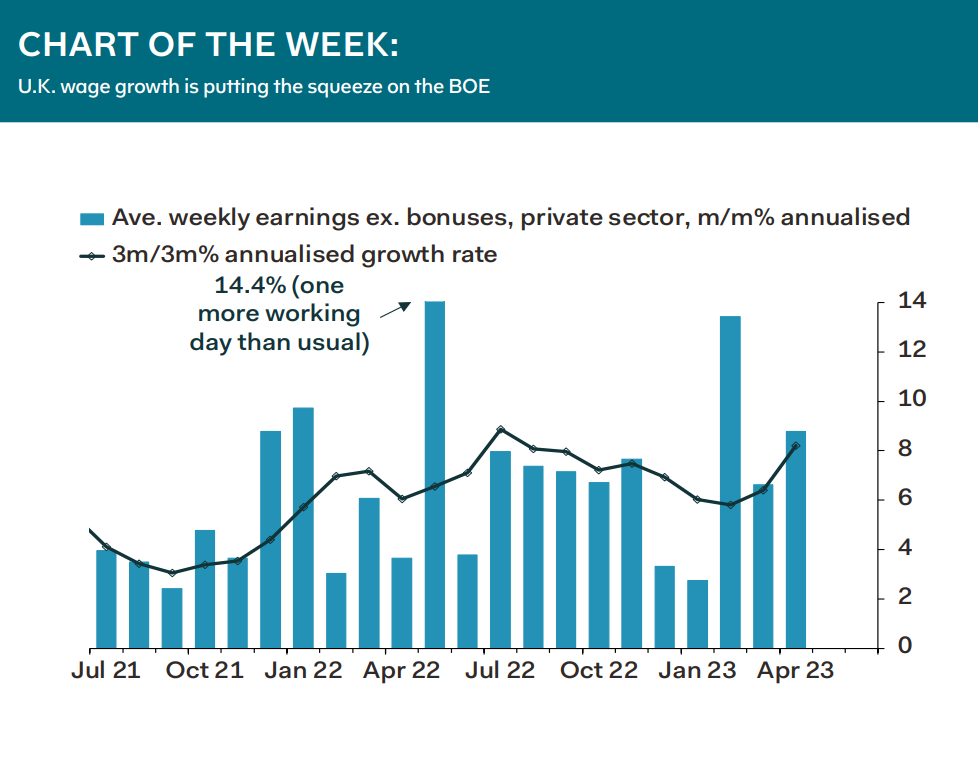

Bond markets in the U.S. and Europe are now able to see the light at the end of the tunnel as inflation is slowly but surely easing, supporting our expectation that the Fed and ECB will soon stop hiking rates. In the U.K., meanwhile, markets are still adjusting their expectations for Bank Rate higher, in response to nasty inflation and wage data. First, core inflation delivered a punchy upside surprise for the month of April, and yesterday, the separate labour market data stung markets with the news that wage growth is now re-accelerating, as our chart of the week shows. Markets now see Bank Rate peaking close to 6.0%, which would imply 150bp worth of tightening ahead. We think the BOE has room to be less aggressive. We see two more hikes over the summer, a “skip” in September, and an end to the hiking cycle in November, at 5.0%. That’s bad news for mortgages, but lower energy prices and higher rates on savings deposits are an offsetting boost. A recession remains unlikely in our view.

Samuel Tombs, Chief U.K. Economist