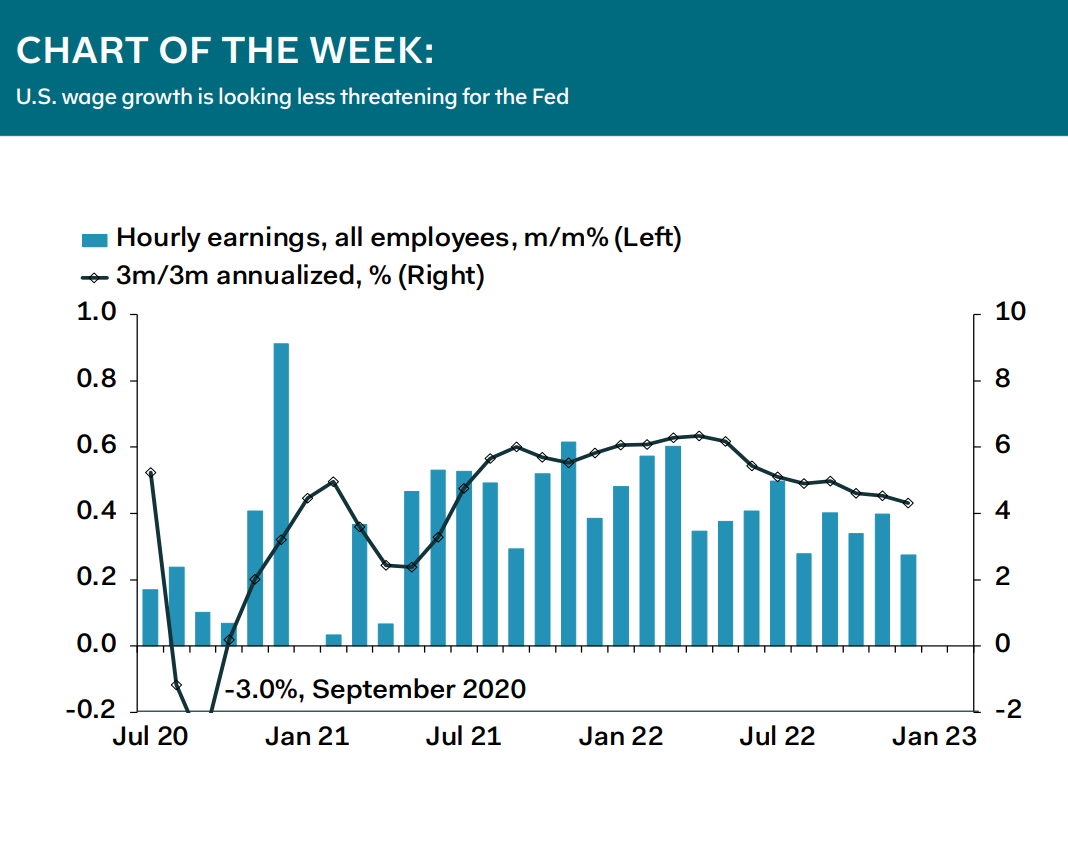

U.S. wage growth was elevated during the pandemic by the mass exodus from the labour force, which left employers scrambling to find people when the economy reopened and

spending surged. Payrolls are now above their pre-Covid level but are still some 7M lower than could have been expected if the pandemic hadn’t happened. But the participation rate remains well below its pre-Covid level, so the unemployment rate is very close to the lows seen before the pandemic.

It would seem reasonable, therefore, to expect wage growth also to be broadly in line with the pre-pandemic pace. Right now, wage growth is still running above the 3¼-to-3½%

pace seen in 2018 and 2019, but the gap is narrowing rapidly. In other words, the wages Phillips curve is re-normalising. This strongly suggests that wage growth can return to a pace

consistent with the Bank’s 2% inflation target without a material increase in unemployment.

The latest data also suggest that Chair Powell’s

fixation on the JOLTS jobs data is a mistake. If employers really are seeking to hire as many people as JOLTS suggests, it’s hard to imagine that wage growth would be slowing so clearly

and rapidly; the opposite would be much more likely. We think the JOLTS data substantially overstate the true number of vacancies. If the downshift in wage growth persists, it will be

impossible for Mr. Powell to continue putting so much faith in the JOLTS numbers, and markets will stop taking his obsession with the data seriously. Rate expectations will fall.

Ian Shepherdson, Chief U.S. Economist